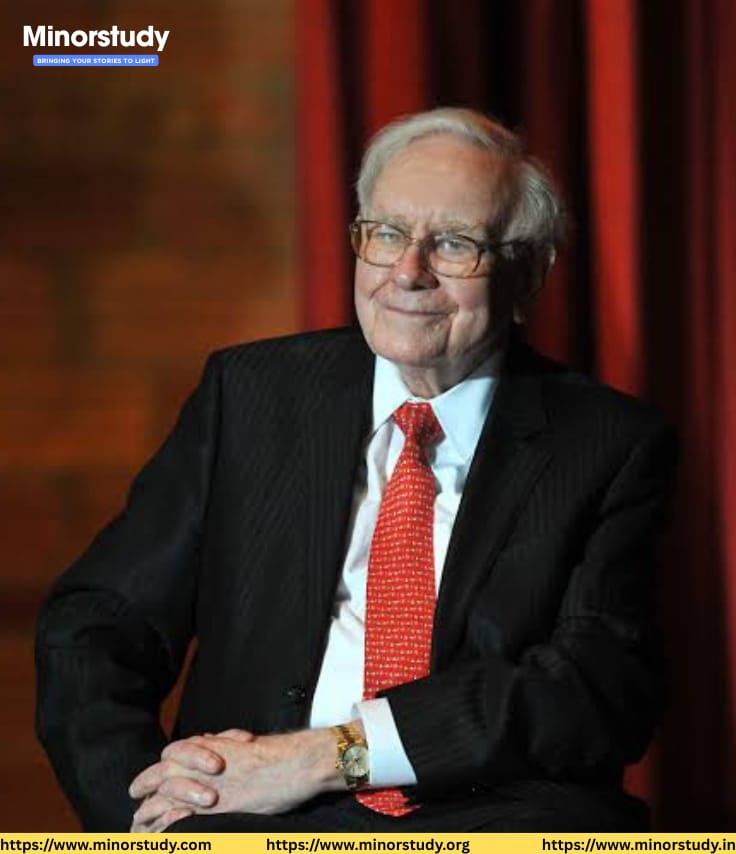

12 Powerful Insights from Warren Buffett’s Journey That Inspire Hope

Warren Buffett, affectionately known as the “Oracle of Omaha,” is one of the most influential investors and philanthropists of the 20th and 21st centuries. His story is rich with lessons in resilience, frugality, generosity, and long-term vision, and it continues to profoundly influence individuals and institutions around the world.

- 👶 Early Life & Formative Years

- 📆 Career Timeline

- 🔎 Fascinating Facts

- ❓ FAQs

- ⭐ Significance of Warren Buffett

- 1. Value Investing Icon

- 2. Philanthropy Role Model

- 3. Frugality & Ethics

- 4. Corporate Simplicity

- 5. Successful Succession

- 🌍 Impact on Daily Life

- 🎈 Wishing Words for Buffett

- 🔑 Key Takeaways

- 🧭 Conclusion: A Legacy of Wisdom and Humanity

This comprehensive guide unveils Buffett’s history, facts, FAQs, timeline, significance, daily-life impact, and societal importance. With over 1,200 words, written in a warm and human tone, it shows why his legacy truly matters.

👶 Early Life & Formative Years

Born: August 30, 1930, in Omaha, Nebraska, to Howard Buffett, a U.S. congressman and stockbroker, and Leila Buffett, a homemaker—both instilled in him discipline and values buffettfaq.com+15britannica.com+15gatesfoundation.org+15thetimes.co.uk+3lifestories.org+3investopedia.com+3.

Young Entrepreneur: At age 6, he sold packs of gum; by 11, he made his first stock purchase with $115; at 14, he bought land as his first real-estate investment thetimes.co.uk.

Education: He studied business at University of Pennsylvania, then earned his B.S. from Nebraska (1951), and went on to Columbia (M.S., 1951), where he studied under legendary investor Benjamin Graham britannica.com+1thetimes.co.uk+1.

📆 Career Timeline

| Year | Event |

|---|---|

| 1951–54 | Worked at Buffett-Falk & Co. and Graham-Newman as a securities analyst en.wikipedia.org. |

| 1956 | Founded Buffett Partnership Ltd. after Graham’s firm closed . |

| 1962–65 | Began investing in Berkshire Hathaway textile company . |

| 1965 | Took control of Berkshire Hathaway, pivoted its strategy to long-term investments . |

| 1970–90s | Grew Berkshire into a giant conglomerate with a ~20% annual return vs S&P 500’s ~10% . |

| 2006 | Pledged to give over 99% of his wealth through philanthropy . |

| 2010 | Co-founded The Giving Pledge with Bill & Melinda Gates . |

| 2025 | Announced succession plan with Greg Abel set to take over Berkshire by year-end . |

🔎 Fascinating Facts

Frugal Despite Billions – Lives in the same Omaha house bought in 1958 for $31,500 and enjoys McDonald’s breakfasts and Cherry Coke businessinsider.com+1reddit.com+1.

Unshakeable Focus – Known for disciplined, long-term thinking; advice from Gates and Buffett alike credits “focus” for their success forbes.com+3investopedia.com+3timesofindia.indiatimes.com+3.

First Shareholder Success – Buffett bought his first stock at 11, filed tax returns at 13, and ran pinball-machine and golf ball resale ventures investopedia.com+3thetimes.co.uk+3forbes.com+3.

Textile Mistake – Considered Berkshire’s acquisition a “$200 billion blunder,” as textile business lagged; yet it became his investment platform .

Value Investing Pioneer – Embraced Benjamin Graham’s principles: investing in undervalued stocks with a margin of safety nypost.com+2thetimes.co.uk+2investopedia.com+2.

Philanthropic Titan – Has donated over $58 billion, including over $36 B to the Gates Foundation, and continues giving via Berkshire shares .

Symbolic $1 Gift – Recently donated $1, sparking discourse on impact and intention in billionaire philanthropy cleverence.com.

Annual Meeting Superstar – Omaha’s event draws tens of thousands, dubbed “Woodstock for Capitalists” investopedia.com+1reuters.com+1.

Legacy Transition – Will be succeeded by Greg Abel (and investment chiefs Todd Combs and Ted Weschler) investopedia.com+5britannica.com+5reuters.com+5.

Love for Simple Joys – He plays ukulele, bridge, and reads six hours daily businessinsider.com.

Icon of Integrity – Ran massive conglomerate with minimal staff, no flashy HQ, modeling principled slow growth thetimes.co.uk.

Cultural Markers – Regular dinners at Omaha’s Gorat’s steakhouse highlight his approachable charm en.wikipedia.org.

❓ FAQs

Q1: Why is Warren Buffett called the “Oracle of Omaha”?

Because his investment insight yielded sustained market-beating returns, and he remains rooted in modest Omaha, Nebraska.

Q2: What is Berkshire Hathaway?

Originally a textile firm, Buffett turned it into a massive conglomerate encompassing insurance (GEICO), railroad, utilities, consumer goods (Coca-Cola, Dairy Queen), and more.

Q3: How did Buffett earn his first dollars?

By selling gum, newspapers, pinball machines, and golf balls as a kid, and investing in land and stocks before teens.

Q4: How generous is he?

He’s pledged over 99% of his wealth, given over $58 B so far, with massive gifts to Gates Foundation and family trusts.

Q5: Is Buffett retiring?

Yes. He’ll step down as CEO by end of 2025, with Greg Abel taking the helm; Buffett will remain as chair in advisory capacity.

⭐ Significance of Warren Buffett

1. Value Investing Icon

He popularized buying undervalued stocks with long-term conviction—reshaping investing philosophies globally.

2. Philanthropy Role Model

His donations sparked the Giving Pledge, inspiring 236 billionaires across 28 countries to share over $600 B businessinsider.com+12investopedia.com+12pictureperfectportfolios.com+12moneyweek.com+4givingpledge.org+4en.wikipedia.org+4.

3. Frugality & Ethics

Buffett proves that immense wealth and modest living can coexist—prioritizing values over vanity.

4. Corporate Simplicity

His lean management—minimal staff, no office glamour—offers a blueprint for sustainable governance.

5. Successful Succession

He prioritized continuity at Berkshire, emphasizing legacy and planning over personal control.

🌍 Impact on Daily Life

Consumers interact with brands owned by Berkshire—like Coca-Cola, Dairy Queen, GEICO, and See’s Candies.

Investors worldwide follow his advice, model portfolios, and annual letters.

Motivation amplified: thousands travel to Omaha each year to hear his wisdom.

Charity sectors are influenced by his mega-gifts and high-impact models.

🎈 Wishing Words for Buffett

“Dear Mr. Buffett, your lifelong journey from chewing gum stalls to global philanthropy inspires awe and gratitude. Thank you for showing us the beauty of integrity, the power of generosity, and the endless potential of a curious mind. May your legacy continue to guide millions toward better decisions and kinder hearts.”

🔑 Key Takeaways

Born in 1930; early business ventures led to Ivy League study.

Built Berkshire Hathaway from textiles to a $1 T+ conglomerate.

Lives modestly, reads extensively, focuses patiently.

Donated billions, pioneering global billionaire philanthropy.

Transitioning leadership thoughtfully to ensure continuity.

🧭 Conclusion: A Legacy of Wisdom and Humanity

Warren Buffett’s life is neither about flashy drama nor quick fame; it’s about steady steps, lifelong learning, unwavering principles, and compassion. His influence reaches far beyond markets—instilling values in everyday decisions, inspiring generosity, and redefining success.

His story tells us that greatness isn’t measured by possessions alone, but by how much good you leave behind. Whether you’re an investor, student, or dreamer, Buffett’s journey is a reminder that simplicity, patience, and heart can indeed change the world.

I’ve read several good stuff here. Certainly worth bookmarking for revisiting. I wonder how much effort you put to make such a great informative web site.

I like this web site very much so much wonderful information.

Spot on with this write-up, I really suppose this web site wants way more consideration. I’ll probably be again to read much more, thanks for that info.

There are some interesting closing dates in this article however I don’t know if I see all of them center to heart. There may be some validity but I’ll take hold opinion till I look into it further. Good article , thanks and we wish more! Added to FeedBurner as effectively