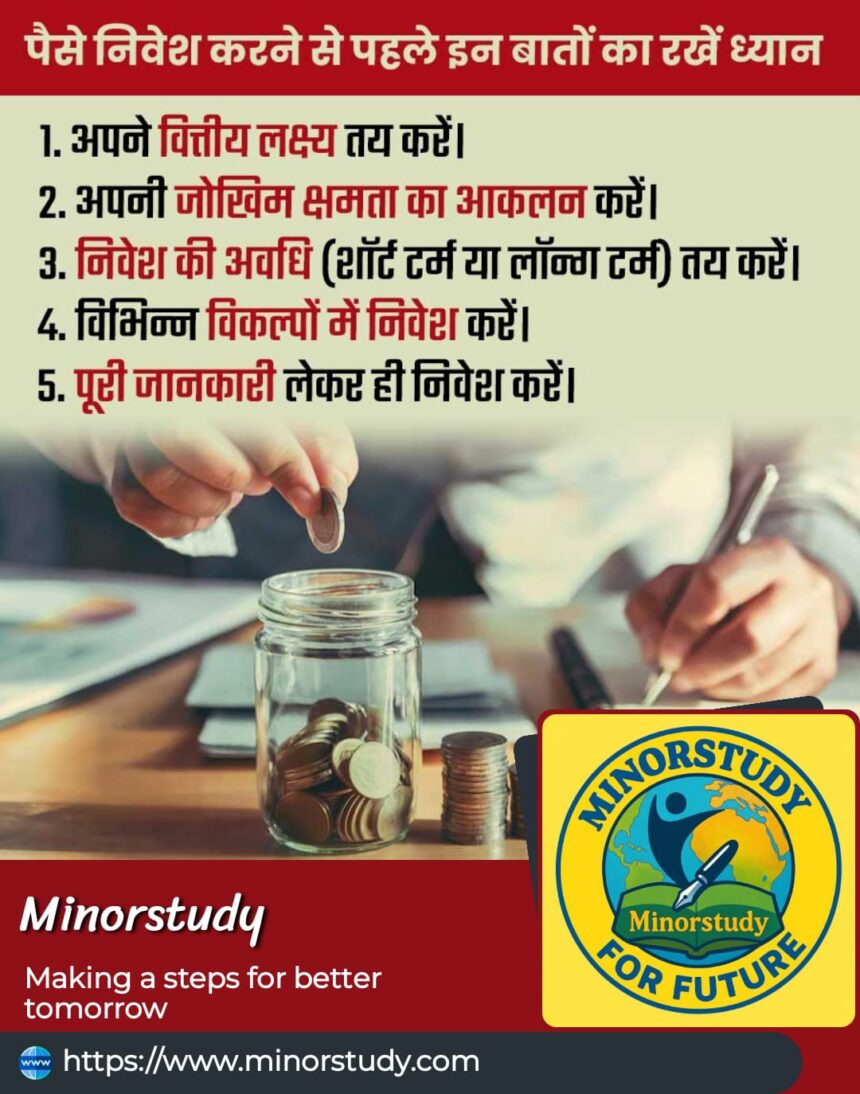

🌟 Introduction: Smart Starts Begin with Smart Thinking

Investing isn’t just about making money—it’s about building your future thoughtfully. Jumping in blind can lead to regret. By following five clear steps—defining goals, assessing risk appetite, choosing time horizons, diversifying, and doing full research—you not only protect your capital, but also grow your confidence and set yourself free to pursue bigger dreams.

- 🌟 Introduction: Smart Starts Begin with Smart Thinking

- ⏳ Timeline & Historical Wisdom: How These Rules Were Born

- 🔍 Step 1: Define Your Financial Goals 🎯

- 🔍 Step 2: Assess Your Risk Appetite 🧭

- 🔍 Step 3: Decide Your Investment Period ⏳

- 🔍 Step 4: Diversify Across Assets 🌐

- 🔍 Step 5: Research Thoroughly Before Investing 📚

- ✨ Importance in Daily Life & Society

- 🙋♂️ FAQs

- 📌 Key Takeaway Points

- 💬 Wishing Words for Investors

- 🧠 Conclusion: Investing with Wisdom & Heart

Let’s dive into each, explore their history and truth, FAQs, and how they play out in everyday life.

⏳ Timeline & Historical Wisdom: How These Rules Were Born

Ancient Roots (c. 935 BCE): “Don’t put all your eggs in one basket” appeared in the Bible (Ecclesiastes), suggesting diversification early on en.wikipedia.org.

Early Investments (~2000 BCE): Sumerians used clay tablets to track loans—evidence of early financial planning osam.com+1en.wikipedia.org+1.

18th Century: Benjamin Franklin discussed opportunity cost—choosing wisely between allocating money or time .

1980s Onward: Vanguard’s index funds introduced cost-efficient diversification news.com.au+15awealthofcommonsense.com+15finra.org+15.

Recent Analysis: Emphasizing tailored risk assessments and robo-advisors for balanced portfolios investopedia.com.

These five steps are not new—they’re centuries in the making, refined by scholars, bankers, economists, and modern financial technology.

🔍 Step 1: Define Your Financial Goals 🎯

What it is: Clarifying what you want and when, like buying a house in 5 years or retiring at 60.

Why it matters: Every investment has a purpose. Clear goals guide risk, timeline, and asset choices.

Fact: Kiplinger advises setting quantifiable targets, such as “$X in Y years” .

🔍 Step 2: Assess Your Risk Appetite 🧭

What it is: Understanding how much loss—or volatility—you can handle, emotionally and financially.

Why it’s crucial: You’ll stick to your plan only if it suits your comfort level.

Expert insight:

“People focus on what feels right, but ability to take risk matters too” investopedia.com+2ml.com+2jgua.com+2.

Categories:

Conservative: Safety-first, Bonds/Cash heavy.

Moderate: Balanced mix.

Aggressive: Equities-heavy for growth.

🔍 Step 3: Decide Your Investment Period ⏳

Short-term vs. Long-term

| Timeline | Profile | Typical Investments |

|---|---|---|

| Short (≤3 yrs) | Goal-oriented, cautious | Cash funds, fixed deposits, short-term bonds |

| Mid (3–7 yrs) | Balanced approach | Debt and equity balanced |

| Long (>7 yrs) | Greater risk capacity | Equities, index funds, real estate arxiv.org+5theguardian.com+5reddit.com+5investopedia.comawealthofcommonsense.com+13investopedia.com+13financialplanningassociation.org+13press.uchicago.eduawealthofcommonsense.com+2jgua.com+2investopedia.com+2investopedia.com+4financialplanningassociation.org+4arxiv.org+4arxiv.org+4usbank.com+4financialplanningassociation.org+4 |

Your horizon affects liquidity needs, tax planning, and emotional resilience during market swings.

🔍 Step 4: Diversify Across Assets 🌐

What it means: Don’t back a single horse—spread investments across asset classes, sectors, and regions.

Why it matters:

Reduces single-point failure.

Smooths out market fluctuations usbank.com.

Formula:

Stocks, bonds, real estate, cash

Further split by geography, sectors, durations.

Some add alternatives like gold or even robo-advisors .

🔍 Step 5: Research Thoroughly Before Investing 📚

What it requires: Understanding potential investments—trends, risks, costs, historical returns.

Why it’s vital:

Avoid scams and mis-selling

Ensure alignment with personal goals.

Modern tip:

Use books like The Richest Man in Babylon, Common Sense Investing, Rich Dad Poor Dad for solid frameworks arxiv.orginvestopedia.compress.uchicago.edu+2en.wikipedia.org+2en.wikipedia.org+2.

Exercise caution with “finfluencers”; fact-check against advisors arxiv.org.

✨ Importance in Daily Life & Society

Personal Impact

Creates financial clarity, control, peace of mind.

Reduces impulsive decisions.

Provides a structured approach—target, risk, time, assets, knowledge.

Community & Society

Encourages financial literacy

Promotes balanced wealth-building

Lowers systemic risk through well-informed citizens.

🙋♂️ FAQs

Q1: Can these steps be combined?

Yes! A goal-based portfolio automatically considers all five.

Q2: Is diversification overkill for small portfolios?

No—start with basics like index ETFs or mutual funds that are diversified by default investopedia.com+11awealthofcommonsense.com+11investopedia.com+11press.uchicago.edu+3en.wikipedia.org+3financialplanningassociation.org+3arxiv.orgmarketwatch.com+10usbank.com+10ora-partners.com+10investopedia.com.

Q3: Should I revisit risk tolerance?

Yes—periodically^ especially after life changes. Advisors recommend reassessment after a market cycle .

Q4: How much research is enough?

Enough to understand an investment’s nature, fees, scenarios, and alignment with your plan.

Q5: Are robo-advisors helpful?

Yes—they streamline diversification and risk math. Use them alongside your own judgment .

Q6: What if investing feels out of reach?

Start small. Building a habit is as important as making profits.

📌 Key Takeaway Points

Goals guide portfolios—know your destination before you plan.

Risk is personal & financial—match your comfort and capacity.

Time affects tolerance—long-term allows more equity, short-term needs safe assets.

Diversification isn’t optional—it’s essential.

Informed is empowered—never buy without insight.

💬 Wishing Words for Investors

“Here’s to intentional investing: may your goals be clear, your risks calculated, your time well-chosen, and your knowledge ever-growing!”

🎯 Perfect for sharing when a friend starts investing or you join a finance group.

🧠 Conclusion: Investing with Wisdom & Heart

These five steps—goals, risk, time, diversification, research—aren’t just smart—they form the bedrock of empowered investing. They blend ancient wisdom with modern tools, shaping not just portfolios but mindsets.

By embracing them, you’re not chasing a quick win. You’re nurturing resilience, clarity, and long-term success, personally and collectively.